France is the most-visited country in the world, attracting around 90 million tourists a year before the pandemic put the brakes on international travel.

The country in general – and the South of France in particular – is also one of the most popular retirement destinations for Brits. If you’re moving to France or planning to buy a holiday home here, you may be wondering how expensive or difficult it is to get a French mortgage.

This short insider’s guide to French mortgages explains what you need to know.

What Types of French Mortgage Are Available?

Just like in the UK, there are many types of mortgages in France, ranging from standard loan repayment to interest only. However, fixed rate mortgages are one of the most popular types of French mortgage. These offer an interest rate that is fixed for the duration of the mortgage.

Fixed rate mortgages guarantee mortgage payments remain at a fixed level for a specified term. In France, you can fix the rates for much longer periods – typically between 15 and 20 years – than you can in the UK, where you can typically expect shorter fixed terms of three or five years.

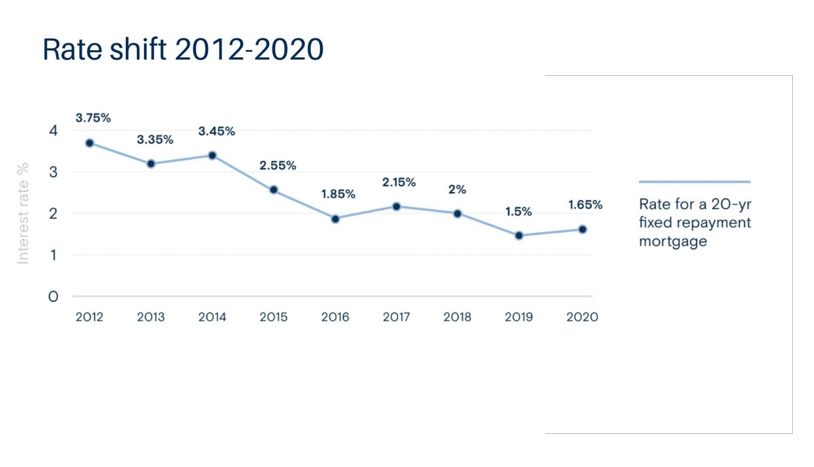

20-year fixed-rate repayment French mortgages, for example, have become extremely popular for non-residents, as rates have dropped to an average of 1.8% or below from 4% in 2011 – just above all-time lows.

(Image source: frenchprivatefinance.com)

As French Private Finance points out, on a mortgage of €400,000, this drop in rates is equivalent to a saving of more than €120,000 in interest over the 20-year term.

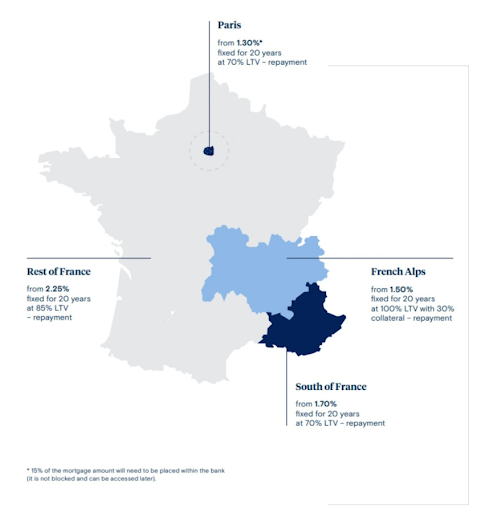

(Image source: frenchprivatefinance.com)

By taking out a long-term fixed rate French mortgage, buyers can lock in these low interest rates and will know exactly how much their mortgage will cost until the entire thing is paid off. Interest rates are currently low across the whole country, including the South of France.

(Image source: frenchprivatefinance.com)

What Is the Process for Getting a French Mortgage?

French mortgage lenders, of course, must lend responsibly. As such, a number of stringent checks are carried out before your mortgage application will be approved. It’s also important to note that Brexit has affected the maximum loan-to-value (LTV) for British buyers. While EU Nationals can get LTV mortgages of up to 80%, for non-EU Nationals – which now includes British buyers – the maximum is 60%.

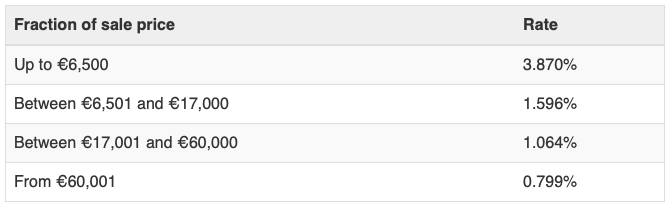

This means that you will need to provide a deposit of 40% and the lender will require proof that you have this money available. In addition, you will need to provide proof that you can pay the notaire’s fees, which are typically around 8%, though are calculated on a sliding scale as follows.

(Image source: frenchprivatefinance.com)

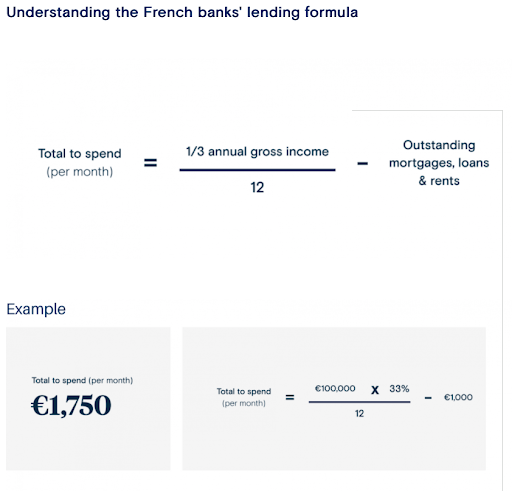

French lenders will also need proof that you can afford the repayments. This is calculated by examining your debt-to-income ratio. Typically, the requirement is that your contractual outgoings once your new mortgage is taken into account do not exceed 33% of your monthly income.

“As a general rule of thumb,” French Private Finance explains, “you can borrow five times your individual or combined (spouses/partners) income for a repayment mortgage in France, less the value of your existing mortgage balance (i.e., outstanding debts on other properties).”

(Image source: frenchprivatefinance.com)

It adds that for interest only French mortgages you can borrow ten times your income – provided you have net assets outside of your main residence which at least equal the value of the mortgage. All that said, however, each lender reviews each buyer’s application individually – so, depending on your circumstances, you could potentially borrow more or less.

Charles Mackintosh South of France Property Surveyor

For more information on obtaining a French mortgage, get in touch with South of France property surveyor Charles Mackintosh. With over 30 years’ experience living and operating in the region, Charles provides highly regarded English language property surveys and advice for British buyers.